Custom Tailored Real Estate Investment Portfolios

Precisely tailored to meet your financial goals.

Investing in real estate is a powerful strategy for building wealth and achieving financial security. Unlike stocks or bonds, real estate offers the potential for steady rental income and long-term property value appreciation.

A Real Estate Investment Portfolio involves the acquisition of properties to generate income and capital gains. Your portfolio can include various property types, such as residential homes, commercial office and retail buildings, or industrial spaces. After the acquisition phase, Expert Portfolio Management is the cornerstone of a successful real estate investment.

PROPERTY ACQUISITION

Regardless of the property type, our acquisition process focuses on identifying assets that align with your specific investment goals. We consider

Overall Financial Assessment

Financial Assessment of overhead

Evaluation and recommendations

Analyze Market

REAL ESTATE INVESTMENT PORTFOLIO MANAGEMENT

Property management is a vital component of a successful real estate portfolio, ensuring the seamless operation and long-term value of the assets. Key contributions include:

Tenant Management

Property Maintenance

Financial Oversight

Regulatory Compliance

Performance Tracking

Simplified Accounting

With over three decades of experience, we have successfully managed hundreds of properties, ranging from single-family homes to multi-tenant commercial buildings. You can trust us to protect and maximize the value of your investment.

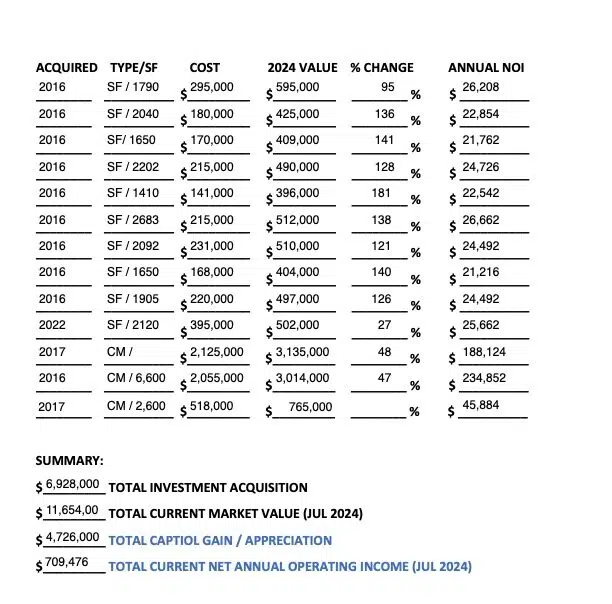

MANAGED REAL ESTATE INVESTMENT PORTFOLIO EXAMPLE

The following information outlines an actual portfolio SwissAm established for clients in 2016. We managed the entire acquisition process, as well as initial and ongoing renovations and property management. This portfolio, which we continue to manage today, consists of 10 single-family homes (SF) and 3 commercial properties (CM). Details on each property’s square footage, acquisition dates, and financials are provided below.

Steps to Invest in Florida Real Estate

- Initial Consultation: Contact us to schedule a consultation and discuss your investment objectives.

- Explore Properties: Browse our listings or let us find properties tailored to your needs.

- Virtual Viewing: Take virtual tours of selected properties.

- Make an Offer: We assist you in making competitive offers and negotiating terms.

- Legal Process: Our legal team will handle all necessary paperwork and ensure compliance with local laws.

- Close the Deal: Finalize your purchase and receive the keys to your new property.

- Post-Purchase Support: We continue to support you with property management and any other needs.

Why Choose SwissAm Real Estate?

-

Experience and Expertise:

With years of experience in the Florida real estate market, we understand the needs of overseas investors. -

Dedicated Team:

Our multilingual team is dedicated to providing exceptional service and support. -

Comprehensive Solutions:

From finding the right property to managing it, we offer end-to-end solutions. -

Client Satisfaction:

We prioritize our clients' satisfaction and strive to exceed their expectations.