Custom Tailored Real Estate Investment Portfolios

Precisely tailored to meet your financial goals.

Investing in real estate is a powerful strategy for building wealth and achieving financial security. Unlike stocks or bonds, real estate offers the potential for steady rental income and long-term property value appreciation.

A Real Estate Investment Portfolio involves the acquisition of properties to generate income and capital gains. Your portfolio can include various property types, such as residential homes, commercial office and retail buildings, or industrial spaces. After the acquisition phase, Expert Portfolio Management is the cornerstone of a successful real estate investment.

PROPERTY ACQUISITION

Regardless of the property type, our acquisition process focuses on identifying assets that align with your specific investment goals. We consider

Overall Financial Assessment

Financial Assessment of overhead

Evaluation and recommendations

Analyze Market

REAL ESTATE INVESTMENT PORTFOLIO MANAGEMENT

Property management is a vital component of a successful real estate portfolio, ensuring the seamless operation and long-term value of the assets. Key contributions include:

Tenant Management

Property Maintenance

Financial Oversight

Regulatory Compliance

Performance Tracking

Simplified Accounting

With over three decades of experience, we have successfully managed hundreds of properties, ranging from single-family homes to multi-tenant commercial buildings. You can trust us to protect and maximize the value of your investment.

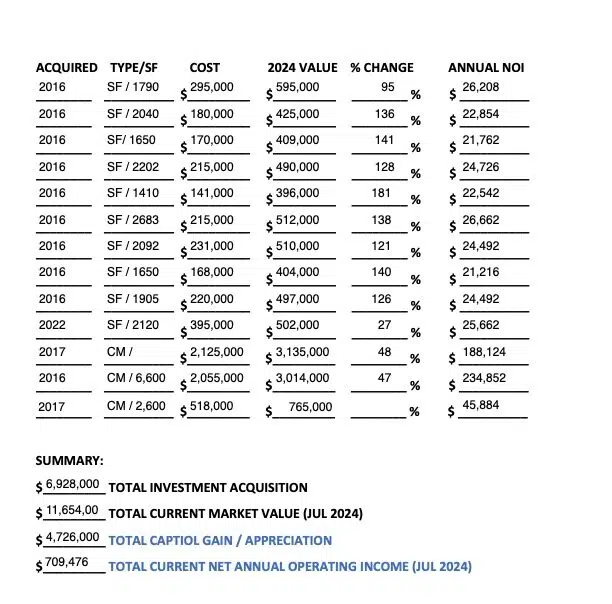

MANAGED REAL ESTATE INVESTMENT PORTFOLIO EXAMPLE

The following information outlines an actual portfolio SwissAm established for clients in 2016. We managed the entire acquisition process, as well as initial and ongoing renovations and property management. This portfolio, which we continue to manage today, consists of 10 single-family homes (SF) and 3 commercial properties (CM). Details on each property’s square footage, acquisition dates, and financials are provided below.

Schritte zur Investition in Immobilien in Florida

- Erstberatung: Kontaktieren Sie uns, um einen Beratungstermin zu vereinbaren und Ihre Anlageziele zu besprechen.

- Eigenschaften erkunden: Durchsuchen Sie unsere Angebote oder lassen Sie uns nach Immobilien suchen, die auf Ihre Bedürfnisse zugeschnitten sind.

- Virtuelle Besichtigung: Machen Sie virtuelle Touren durch ausgewählte Immobilien.

- Machen Sie ein Angebot: Wir unterstützen Sie bei der Abgabe wettbewerbsfähiger Angebote und der Verhandlung von Konditionen.

- Legaler Prozess: Unser Rechtsteam kümmert sich um den gesamten erforderlichen Papierkram und stellt die Einhaltung der örtlichen Gesetze sicher.

- Schließe den Vertrag ab: Schließen Sie Ihren Kauf ab und erhalten Sie die Schlüssel zu Ihrem neuen Eigentum.

- Support nach dem Kauf: Wir unterstützen Sie weiterhin bei der Hausverwaltung und allen weiteren Belangen.

Warum wählen SwissAm Immobilien?

-

Erfahrung und Kompetenz:

Dank unserer langjährigen Erfahrung auf dem Immobilienmarkt in Florida kennen wir die Bedürfnisse ausländischer Investoren. -

Engagiertes Team:

Unser mehrsprachiges Team legt Wert darauf, außergewöhnlichen Service und Support zu bieten. -

Umfassende Lösungen:

Von der Suche nach der richtigen Immobilie bis hin zu deren Verwaltung bieten wir End-to-End-Lösungen. -

Kundenzufriedenheit:

Die Zufriedenheit unserer Kunden hat für uns oberste Priorität und wir streben danach, ihre Erwartungen zu übertreffen.